Diversity and Corporate Success

Does diversity really lead to more corporate success? Nico Hahn investigated this question in a remarkable master thesis at the IU International University of Applied Sciences in Erfurt. Hahn analyzed the diversity of management teams at 47 cooperative banks and related it to corporate success. The company's success was operationalized via net profit margin, return on assets, cost-income ratio, and customer and employee satisfaction. The diversity of the board members of the 47 cooperative banks was assessed using the Big Five Personality Test (B5T®) by Dr. Satow determined. (German version of this post)

In addition to the five basic personality factors (neuroticism, extraversion, conscientiousness, openness, agreeableness), the Big Five Personality Test (B5T®) also records the three basic motives "achievement motivation" (need for recognition and achievement), "power motivation" (need for influence and power) and "security motivation" (need for security and order). The test is available in several languages and can be used free of charge for non-commercial research and teaching purposes. As a measure of the diversity within the management team, Hahn used the standard deviation with regard to these personality dimensions.

The Personality of the Board Members

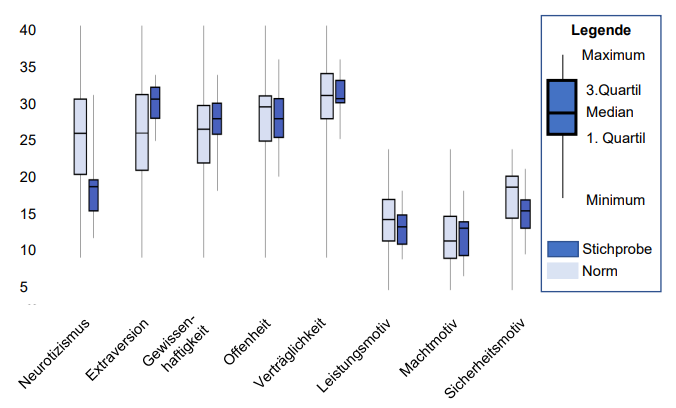

In the first step, Hahn examined the personality of the executive teams and compared it with the norm sample of the Big Five personality test. It was found that on average the board members were a) much more emotionally stable (low values for the personality factor neuroticism), b) much more extraverted, sociable and energetic (higher values for the personality factor extraversion) and c) much less security-oriented (lower values for the basic motive “need for security”) than the norm sample.

The Personality of the Board Members (Hahn, 2023)

Duration of the Team Composition of the Board Members

In the second step, Hahn examined the relationships with the indicators of corporate success: net profit margin, return on assets, cost-income ratio and customer and employee satisfaction. A notable association was found between the duration of board team composition and net profit margin (r = .24). Even if the correlation coefficient is not very large, it is even more remarkable because it shows a connection between a very hard indicator of company success (net profit margin) and a soft, very distant team indicator: the net profit margin is higher the longer the board teams have been working together.Diversity of the Board Members

In the third step, Hahn examined the connections between the diversity of the board members and the company's success. As a measure of diversity within the board members, Hahn used the standard deviation regarding personality dimensions.

Remarkable correlations were also found here: Diversity in relation to the personality dimension of conscientiousness correlated negatively with the net profit margin (r = -.23). Since the correlation is negative, this speaks against the hypothesis that diversity leads to greater corporate success. On the contrary, it seems that an equally conscientious, honest board members has a positive influence on net profit. When only the most conscientious boards were examined, there was an even more significant negative association between diversity in terms of conscientiousness and net profit margin (r = -.33).

A similar connection was also found between the diversity regarding the performance motivation of the board members and customer satisfaction (r = -.32): Here too: Diversity with regard to performance motivation did not lead to higher customer satisfaction - but rather the other way round: An equally performance-motivated board member increased customer satisfaction. Diversity had an even more negative impact on customer satisfaction among executives who were particularly performance-motivated (r = -.63).

A positive correlation between diversity and company success was only found for the safety motive (r = .22): If the board members differed in their safety motivation, customer satisfaction was also higher. If only the particularly safety-motivated board members were considered, diversity in the safety motive was also associated with a higher net profit margin (r = .50).

Summary

The results are remarkable because they demonstrate connections between hard indicators of company success and the composition of the board of directors, and also because they show that diversity is not always an advantage. Rather, it seems that diversity can even be disadvantageous in terms of conscientiousness, integrity, and achievement motivation. Only when it comes to the safety motive does diversity seem to offer an advantage. With this personality dimension, it seems reasonable to have some security-oriented and some risk-oriented leaders on the team.

Literature

Hahn, N. (2023). Heterogene Persönlichkeiten im Vorstand: Die Auswirkungen von sich differenzierenden Persönlichkeiten in Vorstandsteams auf den genossenschaftlichen Unternehmenserfolg. Masterarbeit im Studiengang Wirtschaftspsychologie, IU Internationale Hochschule Erfurt. [PDF]Satow, L. (2020). B5T® Big Five Personality Test: Test and Scale Documentation (ISBN 978-3-949416-00-2)